Quit Your Job

Can you afford to quit your job? When is the best time to quit? Let’s imagine a life without the shackles of the 9-to-5 grind: completely free from the confines of a traditional job.

You wake up on your own time. You get to choose your working hours, determine your lifestyle, and define what happiness means to you.

No more being tied to a monotonous routine that leaves you unfulfilled or unsatisfied. There are no more begrudging work commutes as you’re sitting in rush hour traffic when the sun rises. And you’re not falling asleep on the way home from exhaustion when the sun sets.

You won’t even need to leave home unless you decide to. Even then, it’s on your personal planned schedule of choice. Rejecting the societal norm of employment may seem radical at first glance. But what if opting out of traditional employment could lead you down the path to ultimate freedom and fulfillment?

It turns out that working for yourself is a lot more possible than you would have ever imagined. The opportunities are limitless and much more rewarding than those that you’ll find treading along the traditional career path.

Create a Life > Secure a Job

You might say, “Yeah right Tyler. If that’s the case then why isn’t everyone doing it? What about job security? My retirement pension? What about my insurance? I can’t just accept responsibility for my financial future and take charge of my destiny like that. I’ll be broke and out on the streets!”

Initially, these arguments might seem plausible, but they’re only excuses your mind has fabricated to justify the beliefs and fears that society has instilled in you. There is a better way to move forward and achieve what you want in life without climbing the corporate ladder.

This isn’t a call for laziness or idleness either. It’s a rebellion against the confines of a system that often limits creativity, stunts growth, and stifles passion. It’s a firm stance against an outdated institution that continues to take more than it gives.

It demands a change in viewpoint and a slight deviation from the conditioning we’ve all unknowingly come to accept. It also requires a little bit of patience and some due diligence. But if you’re reading this, I know you’re starting to question the system’s validity, pondering if there is indeed a smarter approach.

1. The Job System is Broken

To start, I’m not suggesting you quit your job without a plan in mind. We all need money to survive, of course. And I’m sure you don’t want to become the next panhandler on the side of the highway.

The easiest way for most to attain money is to exchange one’s time for an agreed-upon salary or hourly wage. In the past, this made sense when living costs aligned with minimum wage and productivity growth continued to adjust for inflation.

However, it’s now 2024 and the minimum wage has not kept up with inflation since 1968!

Yeah, you read that right. Also, consider the steep price rises in food, water, rent, and utilities, alongside modern luxuries like streaming services, internet, and phone bills. Now we are looking at a pretty gruesome picture laden with debt and late or possibly unpaid bills…

Here is another interesting graph chart that compares the value of minimum wage from 1938 up to today. Adjusted to today’s US dollar value, the minimum wage is a stark 40% lower than its 1970 equivalent. Surprisingly, if the minimum wage had kept pace with inflation and productivity, workers would now earn around $24 per hour.

But they aren’t. So tell me what’s wrong with this picture? The federal minimum wage still stands at a mere $7.25 per hour. Yet, the average US household spends $61,334 a year. How are individuals supposed to support themselves or their families with that?

I also realize that state minimum wages vary, but even those average out to only about $12-15/hr. A best-case scenario only clocks your annual earnings to around $31,200 – a little over half of the average US household spending.

2. But What About College?!

Some may argue the importance of college. Oppositions may include the following:

People aren’t meant to remain stuck at minimum wage throughout their lives. It’s only meant to serve as a stepping stone to something better. Higher education will give way to better work opportunities thereby increasing the possibility of higher income. If you want to earn more, you have to invest in your education first.

And if you came to me with these arguments a few decades ago, I would wholeheartedly agree with you.

However, times have changed, and that model has been obsolete for quite some time. For starters, the average cost of college is now approximately $36,436 per student per year. This includes books, supplies, and daily living expenses. After four years, attaining a bachelor’s degree can cost well over $150,000.

Want to go for your Master’s? Let’s add an additional $50k – $80k. Feeling ambitious for your Ph.D.? That will be another $163,600-$327,200.

Unless you’re from a wealthy background or on a full-ride scholarship, affording such expenses is impossible for many. Should you take out multiple loans to fund your education, you’ll likely grapple with that debt for a lifetime.

Why College is Now Obsolete

Now I realize that college is necessary for some professions. But the fact is, most of society cannot afford to take on the kind of financial burden that comes with earning a degree in America. Apart from academic pressure, today’s students are often juggling two to three jobs just to cover living expenses and pay down those hefty student loans.

Over the last two decades, college costs have more than doubled.

More people continue to enroll in college, pursuing degrees as they equate success with higher education. But today, college graduates contend with far more competition than they did not even fifty years ago.

To distinguish themselves for employment, most need to pursue a Master’s, increasingly the norm, or aim for a Doctorate just to get their foot in the door. But at the cost of almost $200k-500k? Is it worth the price tag?

Upon graduation, entry-level positions often provide low pay (around $20/hr), some including unpaid internships, further straining financial prospects.

So let’s break down the traditional job route equation:

- Go to college

- Bury yourself in debt to fund your education

- Earn your degree

- Possibly accrue more debt to further your education

- Secure an unpaid internship and work for the experience of making money someday

- Then start at $20/hr to repay massive student loans

- Cry yourself to sleep

Sounds like a good deal right?

3. Create Your Job

This post isn’t aimed at exposing the fundamental flaws of the educational system. But you can see the point I’m getting at right? The burden of securing a high-paying job just to settle the loans that facilitated it feels like a bad trade-off. Before you realize it, a significant portion of your life may elapse before you even begin to reap the rewards of your educational achievements.

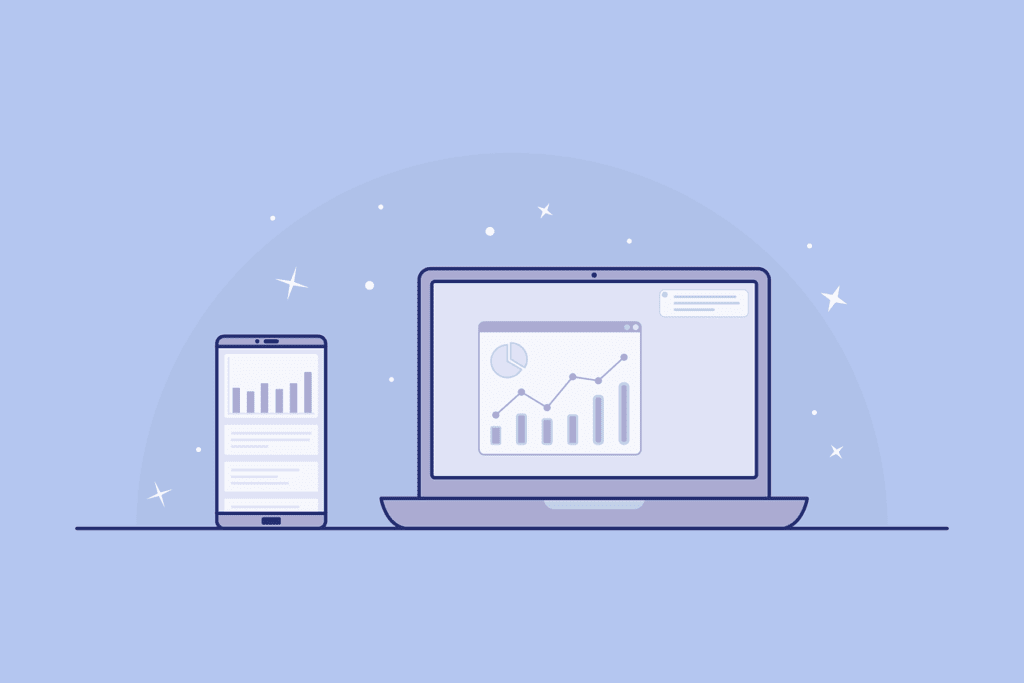

Thanks to technology and the internet, however, crafting your dream job can be much more affordable and rewarding than traditional higher education.

The traditional career path that worked in the past is beginning to shift, and it’s time for people to acknowledge this. In today’s working world, you need to adapt, and you have to get creative. If you want to succeed in the 21st century, you have to utilize the tools you are given.

From social media influencers and content creators to independent contractors, affiliate marketers, Etsy craft makers, musicians, and virtual teachers. The possibilities are endless. The internet now empowers you to leverage and monetize your skills by offering value to those seeking your unique talents. Not only are self-employed people, on average, wealthier than those working traditional jobs, but they are also happier because they are doing what they love.

4. Time is Money

So what if you’re not working 40 hours a week? Since when did we correlate the amount of time we work with the amount of money we can earn? Trading your time for money is possibly one of the worst exchanges you can make.

Why would you only want to get paid when you’re working? Wouldn’t you rather automate your earnings and make money around the clock even when you’re sleeping?

Schools don’t focus on this topic much, but passive income is highly undervalued in terms of the abundance of wealth it can create. Examples may include monetized blogs/videos, song/book royalties, affiliate marketing, investing in the stock market, and sponsored partnerships with companies.

The concept involves a bit of initial upfront work which will eventually lead to ongoing monetary returns over time.

Smart people learn how to generate income 24/7. Everyone else accepts the standard 40-hour workweek as the best model to ascribe to for making money. By equating time to a fixed dollar amount, there is only so much money you can scrounge up. You need to start learning how to diversify your income streams instead of relying on that one weekly paycheck.

5. A Job Offers Limited Experience

Not only are you capped on income potential in a traditional job, but your work experience will also be severely limited over time. Most traditional jobs require you to do a repetitive set amount of skills day in and day out with very little room for advancement. How often do you find yourself daydreaming at your job wishing you were somewhere else?

The mundane tasks may further perpetuate your disillusionment with the reality you are living. As human beings, we should always be striving to grow, to be better than we were yesterday. When we feel stuck, life starts to look like one big rerun with no silver lining in sight. The bleak picture is that every day you live looks like all the others with very little variance.

This lack of variety in your workplace carries with it several negative mental consequences. Some of these include stress, boredom, and depression. Treading down this path for too long will inevitably cause you to miss out on some life-changing opportunities and precious life moments. Exploring the world, starting a business, and spending time with those you love all get put on the sidelines while you’re busy punching numbers into a spreadsheet.

6. Loss of Control

This lack of control over the variables that run your workday leaves a lot to be desired. Other than daydreaming fantasies of being elsewhere, the compounded effects of the strict code of conduct can be suffocating over time.

The employee handbook dictates the appropriate behavior for work. You must follow strict guidelines when conducting your business affairs. The uniform must be adhered to at all times otherwise you risk getting a write-up. If you don’t meet your quota for the month, you run the possibility of being let go.

Any deviation or notion of stepping out of line runs the risk of reprimand. There must be order in the corporation otherwise all of the pieces will fall apart. Keep your head down, do your job, receive nominal pay, and go home. If you don’t follow these instructions, disciplinary action will be strictly enforced.

You wanted some time off to go out and experience life? Well, they have to approve of it first and make sure they can afford to let you off for two weeks out of the year. Do you feel like you’ve been going above and beyond and deserve better pay for your work? Yeah, you have to ask for that too. The business must assess if it can afford to compensate you accordingly for your added value.

So you’re giving up all of that autonomy, all of that control for what? A steady paycheck?

7. A Job is a Fickle Thing

The icing on top of this cake is that most employers can terminate employees “at will,” meaning at any time for any reason. So let’s get this straight. You are giving up all autonomy at your job. Your financial future is in the hands of your employer. All of the variables are controlled by them. They determine your behavior, uniform, quota, and what you are compensated for. Time off must be approved before you make any meaningful life plans. And they can let you go without a moment’s notice? Wow, sounds very stable and secure to me.

If an economic downturn occurs, do you trust your employer to retain you if they need to cut costs to survive? Payroll is often the largest expense for most companies. So where do you think the company is going to start making cuts to save itself from going under? Whether it’s being let go, reduced hours, or a pay decrease, the fact remains the same.

You are getting the short end of the stick here. It’s nothing personal, it’s just the cost of doing business.

Regardless of the company you work for, no one is going to prioritize your finances as much as you. Why endure the uncertainty of business politics when you can implement strategies to make sure you have your own safety net in place? Wouldn’t you feel more secure knowing you control your financial destiny? Not only that, but the tax deductions make it well worth the extra work in getting your business rolling.

8. Employees Are Taxed to Death

Did you know that employee income is the most heavily taxed there is? The average American employee spends approximately 25-30% of their annual income on taxes. That means if you were to earn $200,000 a year, about $60,000 of that is handed over to the government before you even see it. 30% of your money is a lot to just hand over.

Think businesses or self-employed people suffer the same fate? Despite the controversy, many businesses, irrespective of size, leverage tax laws to their advantage. This includes tax write-offs, necessary business expenses, and other costs of operating their livelihoods.

You see, in the income-generating world, it’s what you keep not what you earn that matters most. Businesses understand this concept. As an employee, you’re obligated to pay the full tax amount to the government with very few deduction options.

There aren’t any costs of doing business on your end. You simply show up, clock in, and get paid. You might think that putting in a little overtime for some extra cash will help you out, but the equation remains the same. The more money you make, the more Uncle Sam makes.

However, if you are self-employed or operating a small business, you can slash that number in half to about 15.3%. Once your business is established, additional tax deductions can significantly boost your savings in the long term. Going out for drinks with a potential new client – tax write-off. Do you require the Internet to run your operations from home? Yeah, that’s a business expense too. Having dinner with individuals you think might be good for your podcast – there’s another tax deduction. Purchasing a new vehicle? You might qualify for a deduction on that as well.

If you’re interested in all of the benefits you receive and deductions you can claim, check out this full list. It’s truly amazing what you can save in taxes by running your own business.

You see, over time it’s what you save that matters. The amount you save down the road could equate to hundreds of thousands of dollars.

Go Against the Grain

Now I realize that this type of unconventional lifestyle won’t be for everyone. Most people are perfectly content with the status quo and their role in it. That’s perfectly fine. I’m not here to judge anyone’s personal life choices. I’m trying to actively help people achieve their greatest potential in life. That’s the whole point of this website. If you feel you’re already there, no further action is needed on your part.

But if you’re nodding in agreement to the points I’ve previously stated, I know you desire something more. Jobs do hold their importance, but I advocate seeing them as stepping stones to greater things. Use them to fund your life projects, but don’t let them ensnare you in a lifestyle you loathe. There is another option out there regardless of what you’ve been taught.

To initiate these changes, you need to start taking responsibility for your life’s course — action is key. Stop making excuses and believing the lies you’ve been fed. Make small manageable goals that you can work towards so you can start living a life on your terms. Envision the lifestyle you want to have and ask yourself what you can do to get there.

Don’t lose your individuality, and don’t believe the programming society tries to ingrain in you. You do have value and gifts that you can monetize and create a lifestyle around without the need for any employer to keep you financially afloat. Get creative with your ideas and talents because I’m positive there are a lot of people who will pay you for your services.

Invest in Yourself for a Better Tomorrow

It’s not an easy route, but it’s well worth it once you end up on the other side. You’re going to be working for free for a while. You’ll invest your spare time and a lot of money to kickstart and propel your projects forward. I can guarantee you won’t be spending as much as traditional college though. Look at it as an investment in yourself.

You’re taking back control of the things that matter to you. The investments you make on the way to creating your own business will pay themselves back over time. If you stick with it long enough and you keep working at it, it will pay off.

A lot of traditionalist thinking when it comes to holding a job derives from a scarcity mentality. Fear makes you believe that if you try to venture out on your own, you will inevitably fail and be worse off than if you just stuck with the routine you hated so much.

We all need to start transitioning from a scarcity mentality to one of abundance and prosperity. There is more than enough wealth to go around. Everyone out here is waiting for the unique gifts you can offer. So what are you waiting for? Get started today and finally break free from the rat race.